If you can’t afford an accountant, try an app on your smartphone. Many budgeting apps can help you track spending, monitor expenses and see how your investments are doing. Here are the best budget apps we recommend for 2022.

If you’ve never used a budgeting app, you’re probably unsure about what to expect. Think of them as tools you can tailor to your finances. You use these apps to plan where every dollar goes.

They’re different from coupon apps, which you use right before making a purchase. Tap or click here for five apps that will save you money on things you’re already buying. Budgeting apps are unique in that they empower you to be mindful about your spending, boost your savings and create personalized budget plans.

That’s why we’re sharing three of the best budget apps

You’ve probably heard about Mint, which is pretty standard. It has high ratings in both Google Play and the App Store. Tap or click here to use Mint to manage your finances all in one place.

Folks love it because it’s free, and it’s easy to use across platforms because it syncs different account types. Although that’s impressive, it’s not ideal for people who want to plan ahead for their money.

Mint is best for people who want to track it and see where it’s going. So if you’re looking for a more active way to control your money, here are three apps that let you manage it in new ways.

1. You need a budget. No, really. YNAB!

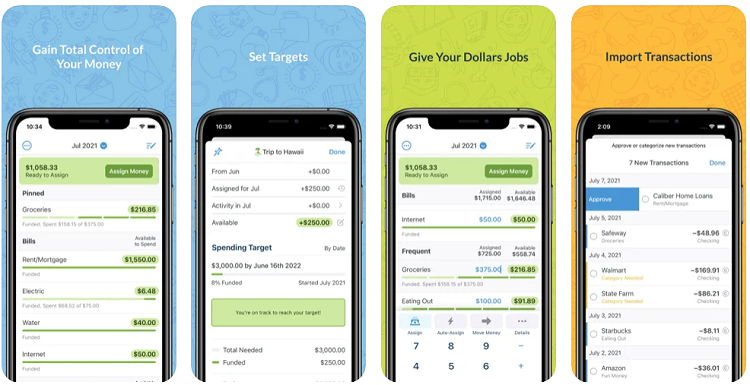

When you look up the best budgeting apps online, you’ll probably find YNAB neck in neck with Mint for the top spot. That’s because YNAB has a ton of robust features you can use to take charge of your personal finance goals.

Although Mint lets you regularly review your accounts, YNAB enables you to be more proactive. You get reports on net worth, spending and income vs. expense.

Unlike Mint, which only lets you set a budget for a month, YNAB can set budgets for a few months in advance. However, you have to pay after the free trial period ends. Costs are $14.99/month or almost $100 for a year.

However, it may be worth it if you want a budgeting app that lets you get your hands in the dirt. You can be proactive, which may help you save more money than other options. It’s easy to use and doesn’t have ads or offers cluttering your screen.

2. Get on top of your money with PocketGuard

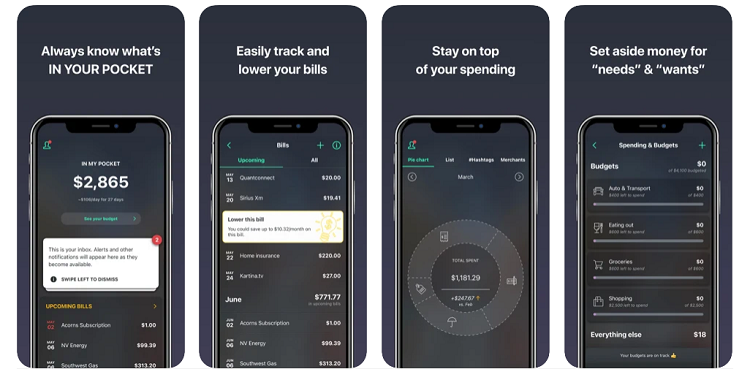

If you tend to overspend, this is the app for you. PocketGuard uses an algorithm to track your expenses, income and savings goals. It’s a simple and easy way to see how much you spend every day.

Instead of crunching numbers, you can whip out PocketGuard and see how it simplifies expense tracking and bill monitoring. PocketGuard’s In My Pocket feature shows you have much disposable income after paying your bills, saving for goals and setting aside cash for needs and wants.

It creates different reports so you can understand your finance health from different angles. For example, it may share a report on your spending habits, so you can realize where you’re spending too much money.

These customizable reports help you get a better understanding of your financial situation. Since you can connect multiple accounts, you can get a bird’s eye view of your financial situation all in one place. You can track your spending and pay off debts by setting schedules and personalized payback strategies.

Oh, and PocketGuard comes with a bill organizer feature so you stop missing due dates. It’s a great way to stretch your dollar even further — although it has a bit of a learning curve. Don’t be discouraged if you aren’t using it to the fullest potential right away. There’s a lot to learn, so take your time and let PocketGuard help you.

3. Qube Money mixes modern convenience with old school style

Remember the old cash envelope system? People would create envelopes and write “Vacation budget” or “College budget.” Over time, they’d slide cash into each envelope until they finally reached their goal.

Now that everything is digitized, few people use that system anymore. But if you’re longing for a return to those old budgeting styles, you’re in luck. Qube Money is like the old envelope system — but in app form. It uses a digital card system you can use to set different budgets.

First, you transfer money into your Qube Cloud. Then, you can create different qubes, or envelopes, to reflect your budgeting goals. If you want, the app can automatically split your money equally into different accounts.

Qube Money has customized features to give you maximum control over your budgets. For instance, you can choose which envelope you’re spending from before making a big purchase. You can even set it up to automatically limit spending habits. Even better, it has a robust security system due to its Default Zero features.

Read more

5 best budgeting apps to help get your finances in order