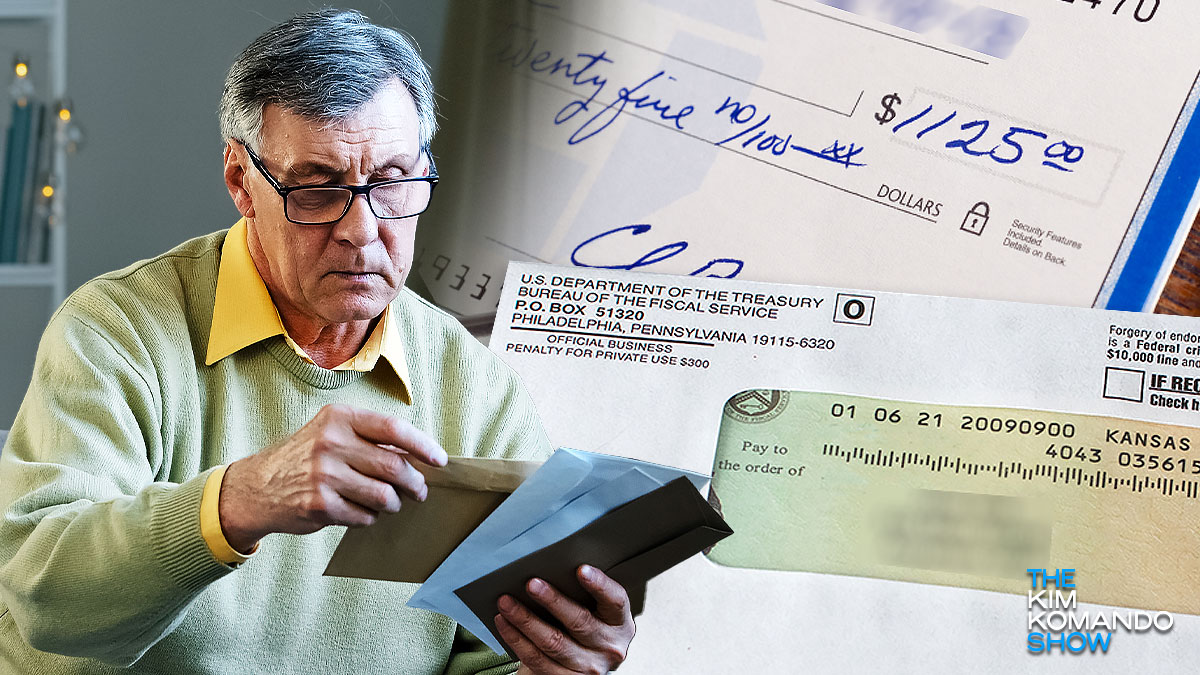

If you’re still mailing checks, now would be a good time to go paperless. New reports show that check fraud has doubled in the past year, thanks to organized crime. Things are so concerning that the Financial Crimes Enforcement Network (FinCEN) warns Americans to stop mailing checks completely.

Need a reason or two to start paying bills online? Keep reading to catch up on the latest stats and steps to protect yourself.

The fraud business is booming

In 2022, banks issued around 680,000 reports of check fraud to FinCEN. That’s a significant jump from the 350,000 reports logged in 2021. The USPS reported 300,000 complaints of mail theft in 2021, which was more than double the amount from 2020.

Although the use of paper checks has been on the decline for years, criminals are still targeting the mail to fuel their scams. People might be writing fewer checks, but the amounts on those checks have increased. The current average check amount is $2,652 compared to $673 in 1990 (or $1,602 in today’s dollars).

Smooth criminals

So, how do these crooks get away with it? Criminals go on a little fishing trip to U.S. postal boxes to steal mail or identify information. They typically target envelopes that look like checks being mailed or bill payments.

Check washing is the most common type of check fraud. This is where a crook steals a check from the mail and alters the payee’s name so they can cash it. They often change the amount of money as well.

These days, some criminals are taking it a worrisome step further. They’re taking the data from checks and using it to get even more sensitive or personal data on their unsuspecting victim. Bad guys creating fake identities, opening lines of credit or even starting up fake businesses have all been reported.

Pay safe, stay safe

If you need to write a check, use a security pen, also known as a check-washing pen. Uni-ball 207 Series pens (4 for around $10 on Amazon) use specially formulated ink that gets trapped into the paper, making it difficult for criminals to wash or erase the ink on a check.

Here are more clever steps to take:

- Monitor your accounts: Regularly review your bank account statements.

- Direct deposit: Use electronic transfers or direct deposit methods for payments instead of checks.

- Secure personal information: Be cautious about whom you give your checking account number and bank routing number. In the wrong hands, these can be used to create counterfeit checks.

- Limit the amount of information on checks: Don’t put your phone number or social security number on your checks.

- Use digital money: Paying bills online eliminates paper checks that can be stolen from your mailbox or trash. Also, use Zelle, Apple Pay, Google Pay, Venmo or other payment apps.

- Secure your mailbox: Send outgoing mail containing checks only from the post office or a secure postal service mailbox.

Don’t want to say goodbye to paper checks yet? Write them out using blue or black non-erasable gel ink. It soaks into the paper and is more difficult to remove. Skip the mailbox and take your checks directly to your local post office.

If you believe you’re the victim of check fraud, don’t panic. Contact your bank ASAP. If you suspect a check was stolen in the mail, file reports with your local police department and the Postal Inspection Service.

Paying bills online is safer than checks, but you must watch for cyber scammers. Use these five tips to avoid dangerous links.

We may receive a commission when you buy through our links, but our reporting and recommendations are always independent and objective.