It’s my job to help people with their digital problems, and it’s sad how often that means assisting folks to sort out a scam. Or even being the one to break the news to them.

Sorry, that new girlfriend isn’t into you. She just wants your money. It happens more often than you’d think — to men and women alike.

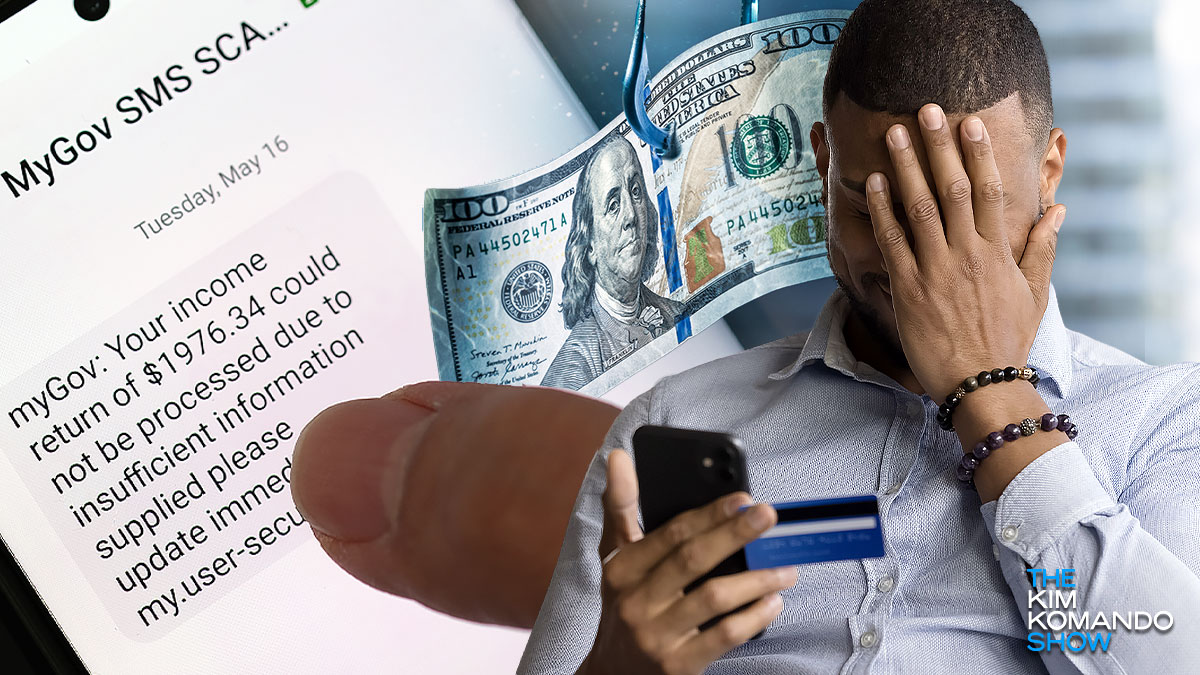

I deal with this all the time, but this number still blew me away: 55% of Americans report being scammed. One in three were victims of identity theft. Major yikes. The more you know about this stuff, the safer you and your digital identity are.

Scammed: By the numbers

Scams aren’t just an emotional rollercoaster. They pack a financial punch, too. One out of three scam victims say they’ve lost money in the last three years. The average scam costs around $1,500.

Here’s what else the survey uncovered:

- 29% of Americans were scammed within the last year.

- Over half have had information stolen in a data breach.

Online shopping scams, credit card scams and identity theft are the most common ways to lose money. Two out of five victims said they didn’t submit reports for what happened because it wasn’t that much money.

Some were too embarrassed to tell anyone what happened. Others simply weren’t sure how to report this kind of theft. (I’ll help with that below.)

As bad as it gets

Online crooks are getting more sophisticated as we speak. But offline scams are still alive and well and just as devastating.

A Nashville woman received a call from someone pretending to be from the El Paso, Texas, Border Patrol office. They told her a package bound for her address contained narcotics and documents.

She was told she needed to pull out $10,000 at a time and put it into Bitcoin machines to safeguard her money. You’re probably thinking, “Who would go that far?”

Unfortunately, whoever called this woman previously stole her identity and had tons of her personal information. They sounded convincing enough for her to fall for the scheme.

Another woman was closing her bar tab when she realized her wallet was missing. What she thought was only a minor inconvenience turned into a years-long nightmare.

Thieves copied her driver’s license, which was later found in a stolen car. They also wrote bad checks in her name, including one for $13,743.80 at Big Lots. What the heck did they buy?

Keep it simple

Thieves still love to use old-school ways to steal your identity. Don’t skip these offline tips:

- Out in public, keep your purse and wallet close. Only bring the cards you’ll be using.

- Leave your Social Security card, birth certificate or passport at home unless you genuinely need them.

- Don’t put outgoing checks, bill payments or financial information in your home mailbox. Using a postal mailbox or taking them to the post office is safer.

- Shred old bills and financial records before tossing them in the trash. I use this shredder.

- Review your credit report and bank statements regularly. Here’s how to get a free report.

📜 You’re not alone if this happens to you. Resist the urge to stay quiet.

Report fraud, scams and bad business practices to the FTC. If you gave out your Social Security number, contact the SSA to tell them your number has been compromised.

We may receive a commission when you buy through our links, but our reporting and recommendations are always independent and objective.